Cash Flow Management: How to move funds quickly and reliably

The world is quickly moving into a digital economy, and HR Ledger is at the forefront of accelerating its company and clients to remain relevant. Cash flow management is no exception to the rule. With too many days between transactions and payroll and the continued suffering of sometimes even making payroll, cash flow is an actual problem for many owners.

Payroll is typically a business’s most considerable expense, and more flexibility is needed to fund payroll without tight deadlines and to sacrifice other purchases just to make payroll. Looser deadlines would be funding payroll even 24 hours before payroll, allowing those last-minute deposits to be made in time.

HR Ledger Cash Flow Management enables fast and flexible payroll funding to improve your cash flow on an ongoing basis. Using this solution, you can free up funds for significant capital expenses, leverage as needed when cash is tight, and help in the event of an unforeseen emergency.

Here are some reasons our clients are currently using this solution (other than just remaining cutting edge, of course):

Why leverage HR Ledger Cash Flow Management?

- Grow your business with increased cash flexibility

- Align payments to your revenue cycle

- Avoid overdraft fees while running payroll

- Gain automatic approval for a $15,000 line of credit

- Acquire competitive interest rates with flexible terms

- Access flexible funding during cash flow emergencies

- Engage with minimal paperwork and no credit checks

- Drawdown every payroll cycle or as-needed with same-day funding

- Pay your workers on time, always

- Ensure peace of mind for every payroll cycle

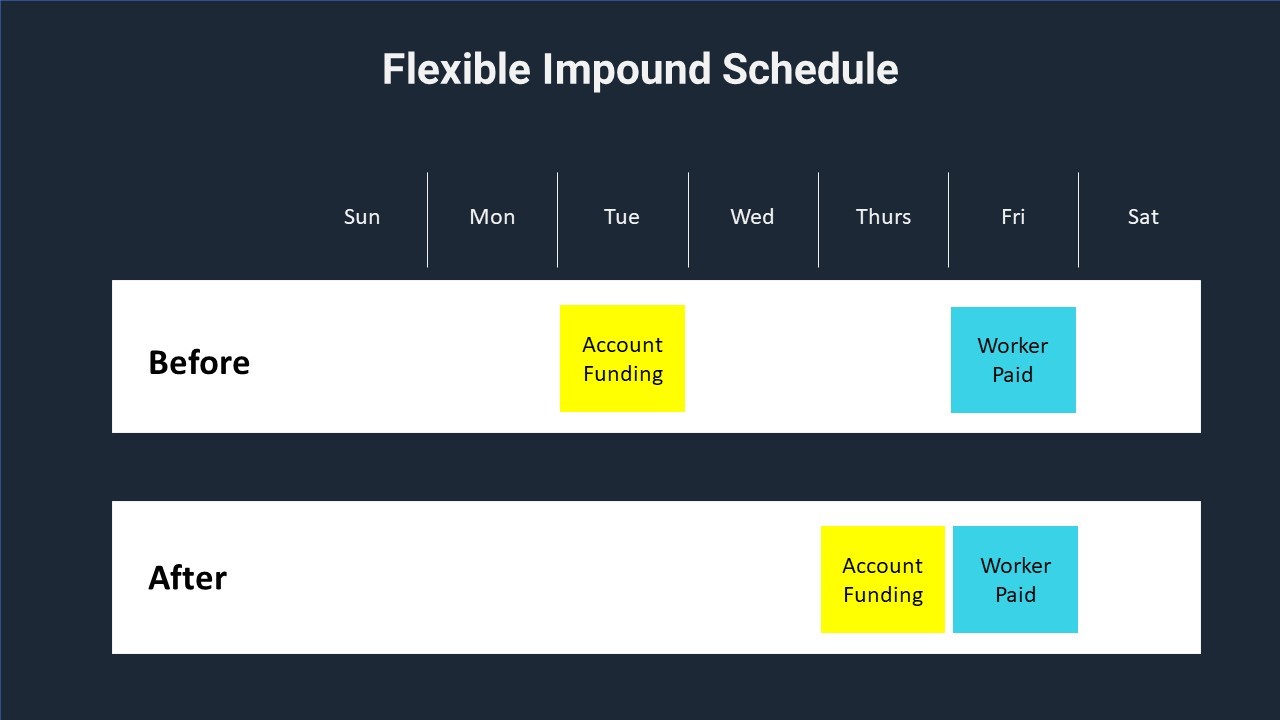

Before this new system, the funding process for payroll typically took three solid days. If you wanted to pay your employees on Friday, you would have to fund by Tuesday to make this happen on time. With the new system, you can fund payroll on Thursday and be able to pay your employees on Friday.

Not only does this provide you with flexible payroll schedules, but it also allows you to:

- Receive extra payments from invoices that previously you wouldn’t have had

- Use a loan to fund payroll at a nominal rate and free up your payroll cash to spend on capital expenditures

- Use a load to fund payroll when you cannot get a loan to fund other projects or R&D

We can help you navigate this entire process. Getting setup takes only a few minutes, and HR Ledger will help you provide the information needed to get you set up and even preapproved for a payroll loan, just in case you need it too.

For more information, visit our page: https://www.hrledger.com/cash-flow-management-nivelo/

HR Ledger can help.

Please call Malcolm or Scott today at 800-451-1136.

Written by: